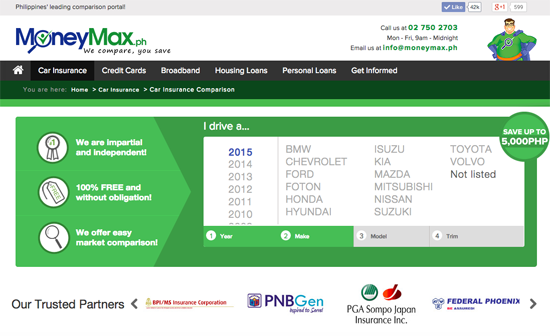

How I Bought Car Insurance without Making a Single Phone Call

Every January, my phone reminds me to automatically renew my car’s insurance policy. This year was different. I told my husband that I want to… Read More »How I Bought Car Insurance without Making a Single Phone Call